Having worked in finance for more years than I care to mention, I have witnessed a multitude of changes in business technology. I remember at one point seeing an actual ‘General Ledger’ – a tome of a book with many lines and columns in it! The many benefits of electronic bookkeeping systems are well known and there is no doubt that technology has been liberating in many respects.

That being said, I do wonder whether there’s a danger that we could become so reliant on sophisticated systems and automated processes, where the majority of things go the way we expect them to, that we lose the ability to deal with the inevitable exceptions to the rules?

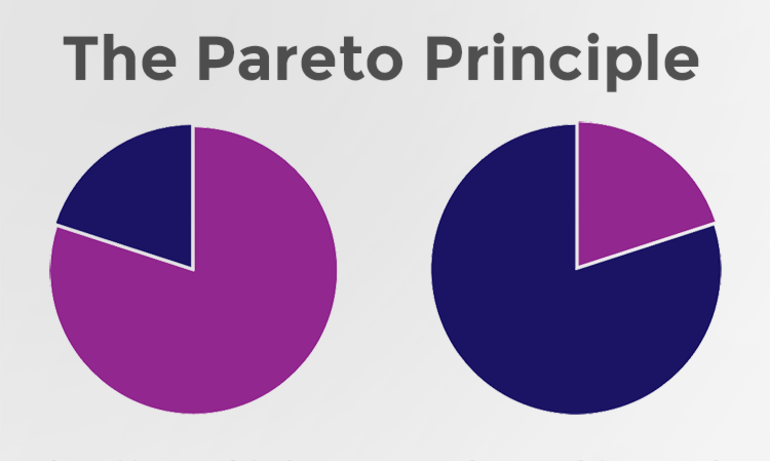

I have been thinking recently about the famous economic rule taught in universities around the world: the Pareto Principle. In 1906, Italian economist Vilfredo Pareto created a mathematical formula to describe the unequal distribution of wealth in his country, observing that twenty percent of the people owned eighty percent of the wealth (although if you believe the Times Rich List this ratio is slightly different these days!)

This is also known as the 80–20 rule.

The general rule of thumb is that roughly 80% of the effects come from 20% of the causes.

Over time, commentators noticed that the 80–20 relationship can be applied to almost any situation. For example, in a finance setting, 80% of the revenue will be produced by 20% of the clients, and 80% of inventory costs will be incurred by 20% of inventory items etc.

The value of the Pareto Principle for a manager is that it reminds you to focus on the 20% that matters.

In Finance processing we have another use for this 80–20 rule. We use a range of sophisticated technology tools that allow us to manage 80% of the workflow in 20% of our time. While this sounds wonderful, the flip side of this is that 80% of our time is spent working on the 20% where there are issues.

In practice, if a manual error is made using the technology it can take up to several months to unwind it. This is generally due to the system being insufficiently flexible to allow amendments or corrections, and in highly automated systems, issues are all too often left languishing due to a lack of knowledge of how to fix them.

The development of technology has also revolutionised the way in which we communicate financial information at work. Paper timesheets with manual signatures posted to an office have been replaced, in the main, by online systems and email communication. These work, in theory, so much more efficiently then old manual systems, but again, the majority of our time is spent sorting out the minority of problems that occur because sometimes things don’t fit within the confines of the program.

Technology can really help in 80% of situations BUT you will still bang your head against a brick wall the other 20% of the time. In these circumstances there is simply no substitute for knowing the correct person to talk to and the correct method to talk to them.

It may be that 80% of the requisite knowledge to complete any task is the ability to successfully use the associated technology, but the additional 20% that often makes the difference is the human relationships element which simply cannot be replaced by even the most sophisticated systems.